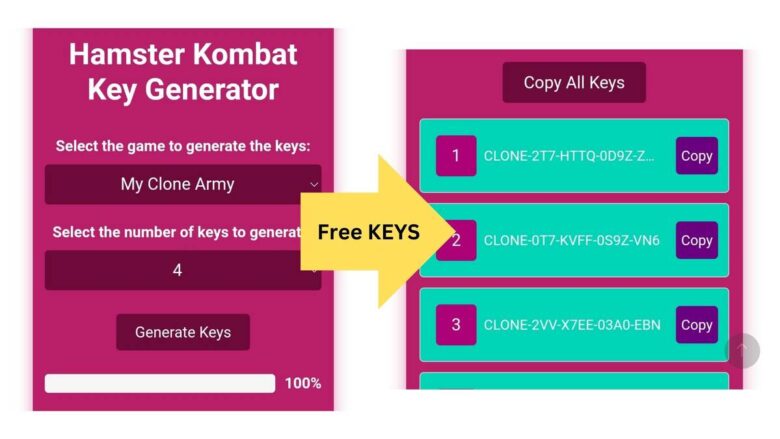

The Hamster Kombat Key generator allows you to get keys for all 9 mini-games in Hamster Kombat in just 108 minutes.

The process of using the generator is extremely simple: choose the mini-game you need, run the generator, and get the keys. At the first stage, the loading may show 0% for about a minute, do not pay attention to this – the keys will be issued in approximately 108 minutes.

Hamster Kombat 6 Playground Games Keys Generator:

- Factory World Gem Stone Generator (new)

- Among Water Gem Stone Generator (new)

- Infected Frontier Gem Stone Generator (new)

- Pin Out Master Gem Stone Generator (new)

- Count Masters Gem Stone Generator (new)

- Hide Ball Gem Stone Generator (new)

- Bouncemaskter Gem Stone Generator (new)

- Stone Age Gem Stone Generator

- Fluff Crusade Gem Stone Generator

- Tile Trio Keys Gem Stone Generator

- Zoo Polis Keys Generator (new)

- Mow and Trim Gem Stone Generator

- Polyshere Gem Stone Generator

- Twerk Race Gem Stone Generator

- Merge Away Gem Stone Generator

- Chain Cube Gem Stone Generator

- Train Miner Gem Stone Generator

Hamster Kombat Generate Gem Stone💎 Here: 👇

Hamster Kombat Airdrop

A token listing on crypto exchanges is expected soon. Register accounts in advance.

Exchanges with listings:

- Bybit.com

- Gate.io

- OKX.com

The expected listing never appeared, but players are forced to spend their time watching ads and completing various tasks. Use the key generator, share it with friends, and appreciate your time, as time is the most valuable resource that cannot be replenished.

What is a Crypto Exchange?

A crypto exchange is an online platform where users can buy, sell, and trade cryptocurrencies. These exchanges act as intermediaries between buyers and sellers, facilitating the transaction of digital assets. Some popular exchanges include:

- Bybit.com: Known for its derivatives trading, Bybit offers a platform for trading crypto futures and perpetual contracts with high leverage.

- Gate.io: One of the oldest crypto exchanges, Gate.io provides a wide variety of cryptocurrencies and advanced trading options like margin trading and futures.

- OKX.com: A global exchange with a strong reputation for its variety of tokens, futures, and staking options, along with advanced trading features.

What is a Crypto Airdrop?

An airdrop in the crypto world refers to the distribution of cryptocurrency tokens or coins to numerous wallet addresses. Airdrops are typically done as a promotional strategy to increase awareness of a new project or token. Here’s how it works:

- Distribution Method: Tokens are usually distributed for free or in exchange for small tasks like following the project’s social media accounts, joining a Telegram group, or retweeting a post. The main aim is to increase the project’s visibility and engage the community.

- Eligibility: Some airdrops are conducted for specific users, such as those who hold a particular cryptocurrency or have been active on a certain platform.

- Purpose: Airdrops help projects gain traction by incentivizing users to hold and trade the new token. It’s a way to bootstrap network effects and create a user base.

- Risks: While airdrops can be lucrative, they can also be risky. Some airdrops are associated with scams or low-quality projects. It’s important to research the project before participating in an airdrop.

How Airdrops Work in the Context of Hamster Kombat

In the case of Hamster Kombat, the airdrop mentioned is likely tied to the game’s in-game economy. As airdrops often precede listings on exchanges, they serve to build excitement and increase the token’s value before it becomes tradable on platforms like Bybit, Gate.io, or OKX.

However, if the expected listing doesn’t occur, participants might feel misled, especially if they were required to watch ads or complete tasks, as in your article. This is a common issue in the crypto space, where speculative hype sometimes leads to disappointment.

Tips for Users:

- Be Cautious: Always verify the legitimacy of an airdrop and the project behind it.

- Check Exchange Listings: Before investing time or money, ensure that the token is listed on reputable exchanges.

- Understand the Value: Airdrops are not guaranteed profits; they are a marketing tool that can fluctuate in value.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (like dollars or euros), cryptocurrencies operate on decentralized networks based on blockchain technology. This means they are not controlled by any central authority, such as a bank or government.

How Cryptocurrency Works

- Blockchain Technology: At the core of every cryptocurrency is a blockchain, a distributed ledger that records all transactions across a network of computers. This ledger is maintained by a network of nodes (computers) that validate and record transactions, making it secure and transparent.

- Mining and Validation: Cryptocurrencies are often created through a process called mining, where powerful computers solve complex mathematical problems to validate transactions on the blockchain. Miners are rewarded with new coins for their work, which is how new coins are introduced into circulation.

- Wallets: To store and manage cryptocurrencies, users need a digital wallet. Wallets can be software-based (online, desktop, or mobile apps) or hardware devices. These wallets hold the private keys needed to access and manage your cryptocurrency holdings.

- Transactions: Transactions with cryptocurrency are peer-to-peer, meaning they occur directly between users without an intermediary like a bank. Once a transaction is validated by the network, it is added to the blockchain and becomes immutable (cannot be altered).

How to Invest in Cryptocurrency

Investing in cryptocurrency can be lucrative but also comes with significant risks. Here’s how to get started:

- Choose an Exchange: To buy cryptocurrency, you’ll need to sign up with a crypto exchange. Some of the popular options include:

- Coinbase: A user-friendly platform ideal for beginners.

- Binance: Offers a wide range of cryptocurrencies and advanced trading tools.

- Kraken: Known for its robust security and variety of trading pairs.

- Create a Wallet: For added security, consider transferring your crypto from the exchange to a personal wallet, especially if you’re planning to hold it long-term.

- Research and Select Cryptocurrencies:

- Bitcoin (BTC): The first and most well-known cryptocurrency, often seen as a “digital gold.”

- Ethereum (ETH): A platform that enables smart contracts and decentralized applications (dApps).

- Altcoins: Other cryptocurrencies like Ripple (XRP), Litecoin (LTC), and emerging tokens that may offer high growth potential.

- Understand Market Trends: The crypto market is highly volatile, with prices that can fluctuate wildly in short periods. It’s crucial to stay informed about market trends, regulatory news, and technological developments.

- Diversify Your Portfolio: Like any investment, diversification is key to managing risk. Don’t put all your money into one cryptocurrency. Instead, spread your investments across different types of digital assets.

- Long-Term vs. Short-Term Investing:

- Long-Term (HODL): This strategy involves holding onto your cryptocurrency for an extended period, betting that its value will increase over time.

- Short-Term (Trading): Involves buying and selling cryptocurrencies over shorter time frames to capitalize on market volatility.

- Staying Secure:

- Use Two-Factor Authentication (2FA): Always enable 2FA on your exchange and wallet accounts to enhance security.

- Beware of Scams: The crypto space is rife with scams, from phishing attacks to fake projects. Always do thorough research before investing.

Why Invest in Cryptocurrency?

- Potential for High Returns: Cryptocurrency has been known to yield significant returns, sometimes in a short period.

- Decentralization: Many investors are attracted to the idea of decentralized finance (DeFi), which eliminates intermediaries and gives more control to the individual.

- Diversification: Adding cryptocurrency to your investment portfolio can provide diversification beyond traditional assets like stocks and bonds.

Risks of Investing in Cryptocurrency

- Volatility: Cryptocurrency prices can be extremely volatile, leading to substantial gains or losses.

- Regulatory Uncertainty: Governments around the world are still figuring out how to regulate cryptocurrencies, which can lead to sudden changes in legality and market conditions.

- Security Risks: While blockchain is secure, exchanges and wallets can be hacked, leading to potential losses.

Conclusion

Cryptocurrency represents a new frontier in finance, offering both exciting opportunities and significant risks. Whether you’re investing in well-established coins like Bitcoin and Ethereum or exploring new tokens and airdrops, it’s essential to do your homework and proceed with caution. As with any investment, never invest more than you can afford to lose.