You may occasionally have to cope with business losses, whether you’re a startup just getting off the ground or an established corporation going through tough times. By enabling you to deduct part or all of your losses from your taxable income, the Internal Revenue Service offers you a break and lessens the pain of the loss.

Losses are not something a business owner wants to experience, but they aren’t always a bad thing. In certain circumstances, they can provide certain advantages.

In this post, we’ll cover how to handle a company loss, as well as loss caps and carrying over excess losses to subsequent years.

Business Loss and Your Personal Tax

Some company owners choose to request emergency funds now, rather than work on every asset that’s left. The mentioned types of losses affect your personal income taxes as well. Limited liability companies (LLCs), partnerships, and S corporations are examples of these business structures.

There are a few types of losses for a small business:

- Net operating losses

- Capital losses or exchange of a commercial property

Selling or trading away a capital asset, such as a company car, piece of equipment, or a building, or an intangible asset, such as a patent or license, results in capital losses. Only losses up to the number of capital gains (or $3,000 if the overall loss exceeds $3,000) may be written off.

You can choose to pay the business taxes as you go by withholding or estimated taxes. But when you spend even a little bit more than earn, your company has losses. As a result, the IRS doesn’t let you deduct all expenses in a comprehensive manner.

Deductible Corporate Expenses

The majority of small firms want to turn a profit and run the risk of suffering losses, thus they may include all usual and required company expenditures when calculating operating profit or loss. These costs consist of:

- Promotional expenses

- HR-related expenses

- Insurance

- Loan interest

- Office expenses

- And more

There’s a team called ‘depreciation” for the spreading out of capital costs for long-term assets like furniture, equipment, and automobiles over a number of years.

Limits for Business Losses

The capital and operating losses both have their limits for a specific tax year. The limitations are applied to business owners, not to businesses themselves.

Net Operating Losses

You may have a net operating loss (NOL), which is restricted to 80% of the individual’s excess taxable income for that year if your total annual deductions exceed your total annual income.

The excessive loss is estimated by beginning with the business’s year net income and deducting any of the following deductions:

- Capital losses in excess of capital gains

- Gain from exchange on a capital business stock

- Non-business deductions

- Net operating loss deduction

Losses from Passive Activities

The number of company losses may be as well constrained by at-risk and inactive operations.

The term “passive activity” refers to a business owner who does not actively manage the company on a regular basis. For example, a partner in a partnership is seen as a passive investor whereas an owner who leases out real estate is considered a passive owner, even if they both actively assist in management.

According to at-risk regulations, a business loss is only allowed to be as much as its net authorized deductions for the year, which include tax amortization and depreciation.

Benefits of Starting a Small Business

Small business is very flexible: you can establish your very own path and work for the best of your customers. You can quickly react to new opportunities, adjusting your strategy for market demands.

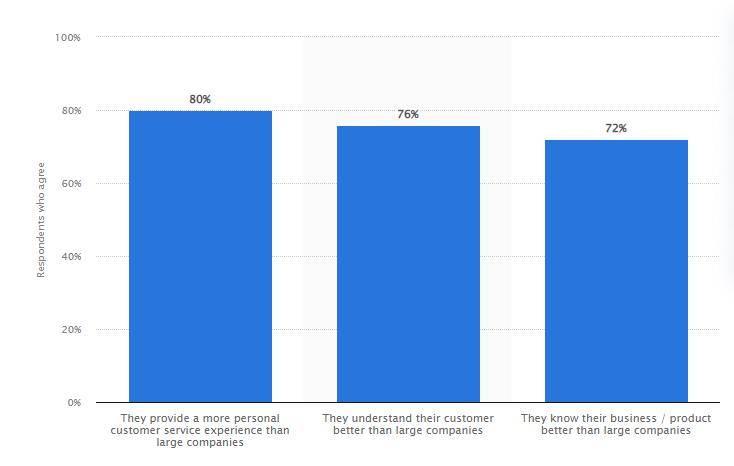

More than 80% of U.S. residents claim that customer service is better at smaller businesses, compared to their larger counterparts. Customers appreciate the in-depth knowledge your workers have, adding to their self-confidence.

How to Claim Your Losses

By summing up all sources of income and deductions credits, net income is computed. Enter the net profit or loss on Schedule 1 of Form 1040 or 1040-SR after completing Schedule C (or another tax form appropriate for your type of business) (for seniors).

Income from other sources is combined with the information from Schedule 1, and Schedule 1 includes any modifications to income.

You must also fill out an IRS Form 461, Limitation on Business Losses. This form sums up all losses from different sources, including operational and capital losses, accounts for non-business losses, and performs an excess business loss computation.

Business vs. Hobby Loans

The IRS thinks that companies are in operation with the goal of turning a profit. Checking if the company was profitable in at least two of the previous five years is one way to determine it.

The IRS will investigate further to determine if you are running a business or a hobby if your company consistently fails to turn a profit. The IRS will then assess your industry, since some firms take longer to turn a profit than others, as well as the efforts you put forth to do so, in addition to your profitability.

Be ready to present an auditor with a log of the hours you invested in your company, as well as evidence of your efforts to increase sales, reduce costs, and increase profits. You may continue to deduct your losses if the IRS finds that you are conducting a business.

Summary of the Main Points

You may be able to claim a business loss each year, but the total amount of your loss may be restricted. If your loss in one year is manageable, you might be able to transfer it over to more prosperous years in the future. However, you don’t always have an opportunity to roll over these losses if the next years aren’t prosperous ones.

The IRS may be concerned if you have a string of years of losses because you are in business to earn a profit. If you have made a profit in at least three of the previous five tax years, the IRS rules assume that you are in business to generate a profit.

Whatever option you choose, remember that the business loss you can take in a year is very limited. You may carry over some of the excess loss to offset profit in future.

Great site, amazing style and design, very clean and user-friendly. Gladi Weber Amatruda.

Thank you very much for your kind words! We’re glad to hear that you find our site’s style and design appealing, as well as its user-friendly interface. We strive to create an enjoyable experience for our visitors. If you have any feedback or suggestions for improvement, please feel free to share them with us.