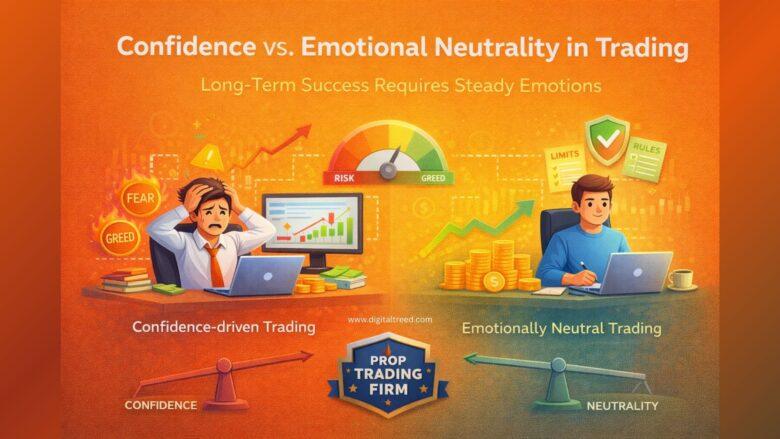

Confidence is often celebrated as a key trait of successful traders. Confidence feels powerful, motivating, and reassuring especially after a strong performance or a funded milestone.

But in funded trading environments, confidence can quietly become a liability.

What keeps traders funded long term isn’t confidence, it’s emotional neutrality. The ability to execute without emotional attachment, regardless of wins or losses, consistently outperforms confidence-driven trading over time.

The Problem With Trading on Confidence

Confidence is state-dependent. It rises after wins and collapses after losses.

When traders rely on confidence, their behavior often changes:

- They increase size after winning streaks

- They hesitate after losses

- They trade aggressively when feeling “in sync”

- They avoid trades when confidence dips

This variability creates inconsistent execution, one of the fastest ways to violate funded account rules.

Emotional Neutrality Is Stable

Emotional neutrality is different.

Neutral traders:

- Don’t feel “good” after wins

- Don’t feel “bad” after losses

- Don’t change behavior based on recent outcomes

They execute because conditions are met not because they feel ready or confident.

This stability is why traders operating under professional frameworks like Funded Trader Markets are encouraged to focus on process consistency rather than emotional highs.

Confidence Encourages Risk Drift

Confidence often leads to subtle risk drift.

Examples include:

- Slightly larger position sizes

- Taking marginal setups

- Ignoring early warning signs

- Trading longer than planned

These decisions don’t feel reckless, they feel earned. But in funded environments, small increases in risk compounds quickly.

Neutral traders don’t feel entitled to take more risk. They follow predefined limits regardless of recent performance.

Neutrality Protects You After Losses

Losses are inevitable. How traders respond defines their longevity.

Confidence-based traders often:

- Try to “regain confidence” by trading more

- Second-guess systems after small drawdowns

- Reduce size inconsistently

Emotionally neutral traders do none of this. Losses are treated as data, not threats.

This response keeps behavior stable and prevents emotional spirals that lead to account failure.

Why Neutrality Improves Decision Quality

Neutral decision-making removes urgency.

Without emotional pressure, traders:

- Evaluate setups objectively

- Pass on low-quality trades

- Accept missed opportunities calmly

- Stick to predefined rules

This clarity is especially important in environments with strict limits, such as instant funding prop firm environments, where emotional mistakes carry immediate consequences.

Confidence vs Discipline

Confidence feels productive, but discipline is protective.

Professional traders build systems that:

- Don’t require confidence to function

- Rely on rules, not feelings

- Produce consistent behavior under pressure

Confidence may fluctuate. Discipline, when built correctly, does not.

Training Emotional Neutrality

Neutrality isn’t natural, it’s trained.

Experienced traders develop it by:

- Fixing risk per trade

- Limiting trade frequency

- Tracking rule adherence instead of P&L

- Viewing outcomes as probabilities, not judgments

Over time, this detachment becomes automatic.

Why Prop Firms Prefer Neutral Traders

Prop firms fund traders who can manage capital responsibly.

Emotionally neutral traders:

- Respect drawdown limits

- Avoid risk spikes

- Execute predictably

- Scale safely

Confidence-driven traders, even when profitable, often introduce unnecessary volatility.

This is why neutrality is often rewarded more than enthusiasm or aggression.

Final Thoughts

Confidence feels good, but it’s unreliable.

In funded trading, emotional neutrality produces consistent execution, stable risk behavior, and long-term survival. Traders who detach from outcomes and commit fully to process are the ones who remain funded through market cycles.

In prop trading, calm beats confidence every time.

Leave a Reply